November’s numbers show a Maui housing market still adjusting to higher inventory levels, longer days on market, and more cautious buyer behavior. While national mortgage rates eased slightly heading into fall, local activity remains tempered, with both single-family and condominium segments seeing softer prices and slower absorption.

The most notable change this month:

The median sales price for condos fell to $595,000, the lowest point of 2025, and Days on Market rose 20.2%.

Given the ongoing uncertainty surrounding Bill 9 and the potential phase-out of STR use in apartment-zoned complexes, additional pricing pressure in the condo market is likely.

Single-Family Homes: Small Dip in Median Price

November brought a small but notable dip in the single-family median sales price:

- Median Sales Price: $1,150,000 (down 11.5% YoY, down from $1,245,000 in October)

- New Listings: Up 9.5% YoY

- Closed Sales: Down 22.2% YoY

- Days on Market: 151 days (up 3.4% YoY)

- Inventory: Up 22.8% YoY

- Months Supply: 8.3 months — a large 40.7% increase YoY

What this means:

Inventory has been rising throughout 2025, and November confirms that the single-family segment is continuing to normalize. The median price dip may be a one-month fluctuation driven by composition of sales, but with supply climbing and Days on Market remaining elevated, it’s worth watching. If this continues over the next 1–2 months, it may signal a larger shift.

Condominiums: Prices Fall Again as Inventory Climbs

The condo market continues to show the most significant signs of rebalancing:

- Median Sales Price: $595,000 (down 19.0% YoY)

- Average Sales Price: Down 23.0% YoY

- Closed Sales: Down 5.7% YoY

- Days on Market: 155 days (up 20.2% YoY)

- Inventory: Up 23.0% YoY

- Months Supply: 15.5 months (up 38.4% YoY)

Key Trend:

For the fourth consecutive month, the condo median has hovered in the $600k range, but November marks the lowest point yet at $595,000. This aligns with increasing supply and the broader caution stemming from Bill 9.

We expect continued downward pressure in early 2026 due to Bill 9 unless inventory tightens or the regulatory picture stabilizes.

Buyer & Seller Behavior Trends

Buyers:

- Are moving more slowly, particularly in the condo market.

- Have significantly more inventory to choose from.

- Are prioritizing turnkey units and renovated properties.

Sellers:

- Must price ahead of the market, not behind it.

- Should anticipate longer DOM, now 155 days for condos and 151 days for homes.

- Should invest in presentation (photography, prep, improvements) to stand out.

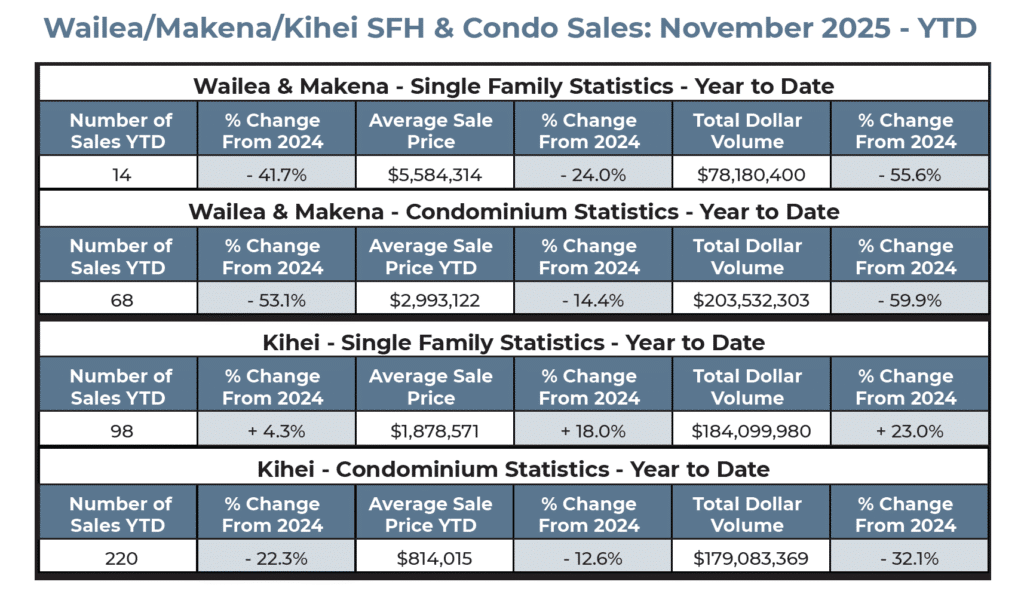

Wailea & Makena Market Update

Wailea/Makena continues to function as its own micro-market; still desirable, still premium, but impacted by broader trends.

Condo Market – Wailea/Makena

- 2 condo sales in November

- Median price: $1,175,000

While sales volume for November was low, this reflects the overall slowdown in luxury condos islandwide, not a decline in demand for Wailea-quality product. Year-to-date, Wailea/Makena condo sales are down 53.1%, but median prices remain above $2M YTD, demonstrating the durability of the luxury segment.

Single-Family Homes – Wailea/Makena

- 2 sales in November

- Median price: $3,620,200

This area continues to command strong prices despite fewer transactions.

Kihei Market Update

Kihei Condos

- 17 sales in November

- Median price: $650,000

Kihei remains one of the most active zones for condos, but the pricing trend reflects the broader market softening, especially for properties affected by Bill 9 uncertainty.

Kihei Single-Family Homes

- 10 sales in November

- Median price: $1,028,000

- Kihei remains relatively resilient in the single-family category, though inventory expansion is also evident.

What’s Shaping the Market Right Now

- Higher Inventory = More Choice, Slower Pace

Both homes and condos are experiencing inventory increases of ~23% YoY or more. - Condos Under Continued Pressure

Median price now at $595,000, the lowest in the past year. - Longer Days on Market Across the Board

Buyers are taking more time, and sellers must adjust expectations. - National Context

Existing home sales on the mainland improved modestly in November due to lowered mortgage rates. Maui has not yet seen the same level of demand acceleration, likely due to unique constraints, insurance issues, and regulation concerns.

Final Thoughts

Maui’s market is in a true rebalancing phase, one defined by higher supply, slower absorption, and selective buyer activity. The luxury segments in Wailea and Makena remain stable in value but reduced in volume. Meanwhile, the condo market continues to see the most dramatic shift, with pricing softening and Days on Market rising sharply.

For sellers: pricing, presentation, and strategy are everything.

For buyers: this is the most negotiable market Maui has seen in years.

With Aloha,

All information taken from Hawaii Information Services, MLS Sales Data and news sources, information shown herein, while not guaranteed, is derived from sources deemed reliable. This Maui real market analysis represents our opinion of Maui Real Estate based on available data and should not be considered financial or legal advice.