Maui’s Condo Sales have dropped and if you’ve been waiting for the right time to buy a condo on Maui, that moment may be arriving. For the first time in years, Maui’s condo market has entered clear buyer’s territory and while this shift is tied to economic trends, it’s also being accelerated by a growing wave of political uncertainty in Maui.

The Stats Are In: Maui’s Condo Sales have dropped and Buyers Now Have the Upper Hand

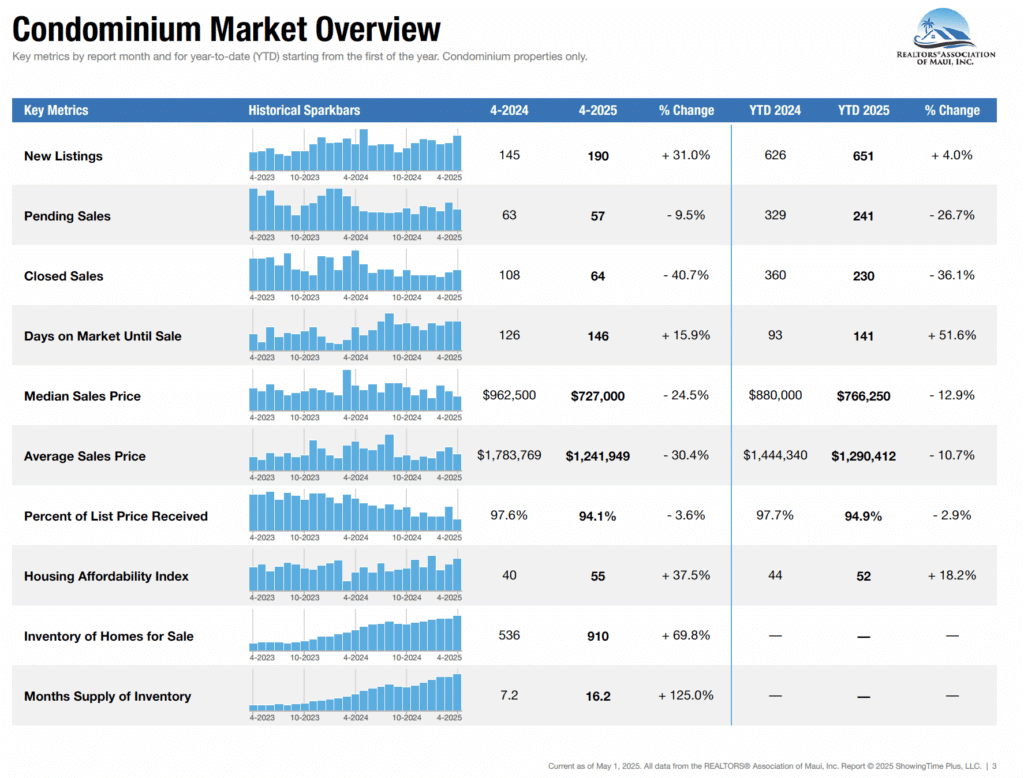

April 2025 data from the REALTORS® Association of Maui confirms what many have already sensed:

- 📈 Maui Condo inventory is up 69.8% year-over-year, the most we’ve seen in over a decade.

- 📉 Maui Condo Prices Drop: Median prices dropped to $727,000, down 24.5% compared to last April.

- 📉 Closed sales fell 40.7%, and pending sales are down 9.5%.

- 🏡 Days on market rose to 146, and the average seller is accepting 94.1% of list price.

- 🏝 Most notably, the affordability index for condos improved by 37.5%—a welcome sign for many local buyers.

This is no longer a low-inventory, high-pressure environment. Buyers have options, leverage, and time to make strategic decisions.

How U.S. Economic Trends Are Shaping Maui’s Market

While Maui’s local politics are playing a big role in shaping today’s condo market, it’s important to zoom out. Across the country, economic conditions are shifting and Maui isn’t immune to the ripple effects.

Mortgage rates remain stubbornly high, with the average 30-year fixed rate hovering just above 7% as of mid-May. That’s keeping some buyers on the sidelines and pushing others to adjust their budgets. According to Forbes, many forecasters now believe rates will stay elevated well into late 2025, especially with inflation proving more persistent than expected.

Meanwhile, the Federal Reserve is signaling caution heading into its June 2025 meeting. The Fed is walking a fine line, balancing the need to keep inflation in check while avoiding tipping the economy into recession. For now, the consensus is no rate cuts in June, and possibly none this summer at all.

International dynamics are also playing a role. Visitor counts from key markets like Canada and Japan are down compared to pre-pandemic levels, and some Canadian travelers are rethinking trips to Hawaii altogether amid recent political tensions and tariff concerns (AP News, NPR). With fewer international visitors and less foreign demand for investment properties, that’s one more factor contributing to rising inventory and why Maui’s Condo Sales have dropped.

Even though Maui’s market is unique, especially with our high rate of cash sales, these national trends still affect buyer sentiment, financing access, and pricing momentum.

In short: Maui isn’t alone in this transition. What we’re seeing here is part of a broader market rebalancing, and it’s giving buyers new leverage in places that were out of reach just a year or two ago.

Island Politics Are Reshaping the Condo Landscape, as a result, Maui’s Condo Sales have dropped

Mayor Richard Bissen’s proposal, Bill 9, aimed at phasing out currently approved short-term rentals in apartment-zoned districts (commonly known as the Minatoya List) is stirring debate and impacting behavior.

With over 7,000 condo units potentially affected, many sellers are listing early, while buyers weigh potential changes in property use and income potential. Even though nothing has passed yet, the conversation itself is affecting pricing and negotiations particularly in areas like South and West Maui, where many Minatoya units are located.

The situation is fluid, but the market is already reacting.

Realtors Association Opposes Bill 9

Earlier this month, the Board of Directors of the REALTORS® Association of Maui (RAM) voted unanimously to oppose Bill 9. This came after the Government Affairs Committee’s recommendation and weeks of meetings, surveys, and outreach. RAM’s stance is rooted in the protection of property rights and the belief that any changes to STR policy should come with balanced, workable solutions for Maui’s residents and economy.

While committed to improving affordability and access, the association believes there are more balanced ways to address these challenges without disrupting Maui’s housing and tourism economy.

Oʻahu Case: A Legal Roadblock for Bill 9?

An important legal dimension is surfacing that’s not getting enough attention. In 2022, a federal judge issued a key ruling on Oʻahu, halting the enforcement of a law (Ordinance 22-7) that would have retroactively increased the minimum rental period in residential areas from 30 to 90 days.

The court ultimately issued a permanent injunction, protecting owners who had been lawfully operating 30–89-day rentals before the ordinance took effect. The judge found that those property owners had vested property rights, and that Honolulu’s attempt to revoke those rights without due process likely violated the Takings Clause of the U.S. Constitution.

However, this protection did not extend to short-term rentals opened after the ordinance was enacted. The ruling specifically applied to property owners who had established their use under existing law and relied on that use over time.

This precedent is highly relevant to Maui. Mayor Bissen’s proposed Bill 9, which seeks to phase out short-term rentals in apartment-zoned areas, could face similar legal challenges, particularly from owners who have operated STRs for years in full compliance with county regulations.

To be clear: this is not legal advice. Zoning laws and vested rights claims are complex, and the implications vary case by case. If you own or are considering purchasing a Maui condo that could be affected by Bill 9, it’s essential to consult with a qualified real estate attorney to fully understand your rights and options.

For buyers, this legal backdrop is part of what’s creating downward pressure on prices, but it also highlights the need for informed, professional guidance in today’s shifting landscape.

Where This Leaves Buyers

If you’re in the market for a Maui condo, especially a condo for personal use or long-term rental, this is a rare window of opportunity, because Maui Condo Sales have dropped. Inventory is high. Pricing is adjusting. Sellers are becoming more flexible. Political developments are creating uncertainty that favors informed, decisive buyers.

The Bottom Line: Maui’s Condo Sales have dropped creating a rare opportunity

Maui’s condo sales and prices have dropped, which means the market is shifting and fast. Inventory is rising, prices are softening, and buyers finally have negotiating power. But this isn’t just a reaction to mortgage rates or national trends. Local policy discussions, particularly around Bill 9, are creating a layer of uncertainty that’s already influencing seller behavior and buyer decisions.

For some, that uncertainty is a reason to wait. But for others, it’s exactly why now is the time to act since Maui’s Condo Sales have dropped.

If you’ve been watching from the sidelines, this may be your window. With more choices, more leverage, and a deeper understanding of the forces at play, both legal and economic, buyers have a rare opportunity to enter the Maui market on more favorable terms.

Navigating that landscape requires clarity, strategy, and the right guidance. If you’re ready to take the next step, or just want a clearer picture of how these shifts could affect you, we’re here to help.

With Aloha,

All information taken from Hawaii Information Services, MLS Sales Data—information shown herein, while not guaranteed, is derived from sources deemed reliable. This market analysis represents our opinion based on available data and should not be considered financial or legal advice.

Curious about the property in our featured image? It’s an aerial view of Palms of Wailea, we have an active listing at this property: unit 1903. Full details at PalmsAtWailea.info.