A Shifting Market Brings New Opportunity

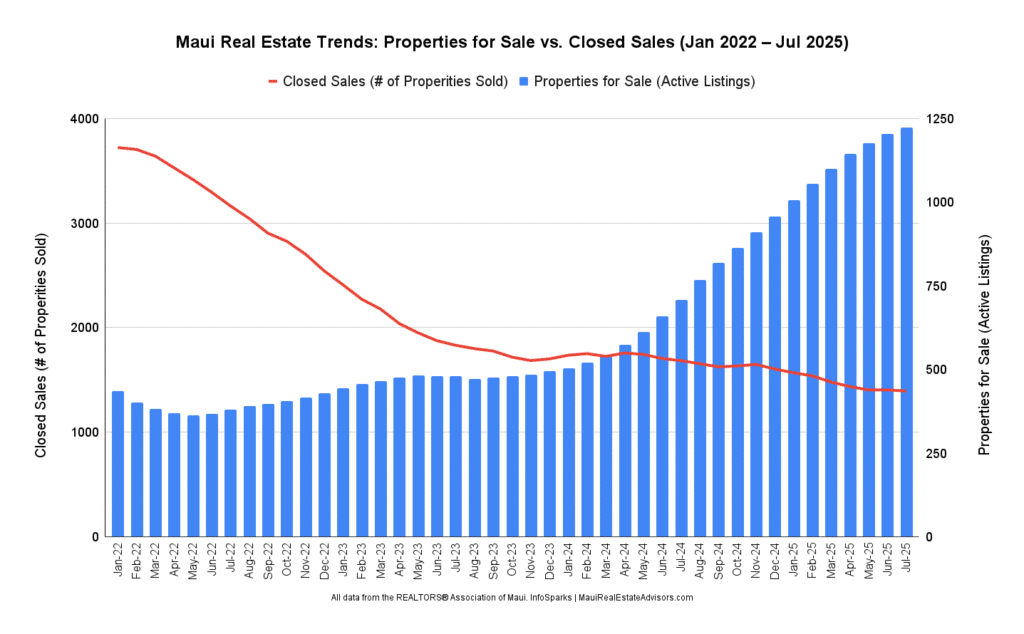

The Maui real estate market is shifting, but not stalling. After several years of rapid price growth and record-low inventory, we’re now seeing a market recalibrating: marked by higher inventory, longer days on market, and more negotiation between buyers and sellers. The change isn’t dramatic month-to-month, but when we zoom out over the past three years, the trend is clear: supply has steadily grown while closed sales have tapered.

In late 2023/early 2024, Maui’s market reached an inflection point. Inventory began rising faster than at any point in the previous three years, while closed sales failed to keep pace. By July 2025, the spread between properties for sale and properties closing each month is the widest we’ve seen since at least early 2022.

The Visual Graph below Shows the Dramatic Shift in Our Maui Market.

- In January 2022, there were approximately 436 Total Active Maui Properties For Sale and there were Approximately 3,722 Closed Sales.

- By January 2024, we start to see this shift when there were approximately 504 Total Active Maui Properties For Sale and there were Approximately 1,736 Closed Sales.

- Now in July 2025, there were approximately 1,223 Total Active Maui Properties For Sale and there were Approximately 1,394 Closed Sales.

This shift is creating an environment where buyers have more choice and leverage than in recent memory, especially in the condo market. Sellers still have opportunities, particularly in high-demand areas, but success now comes down to pricing strategy, property presentation, flexibility in negotiation, and understanding where the market is headed.

For buyers, it’s about recognizing where real opportunity lives. The latest RAM data confirms: we’re in a buyer-friendly environment, but select homes are holding value and moving when priced and marketed right.

Maui Real Estate Market Trends

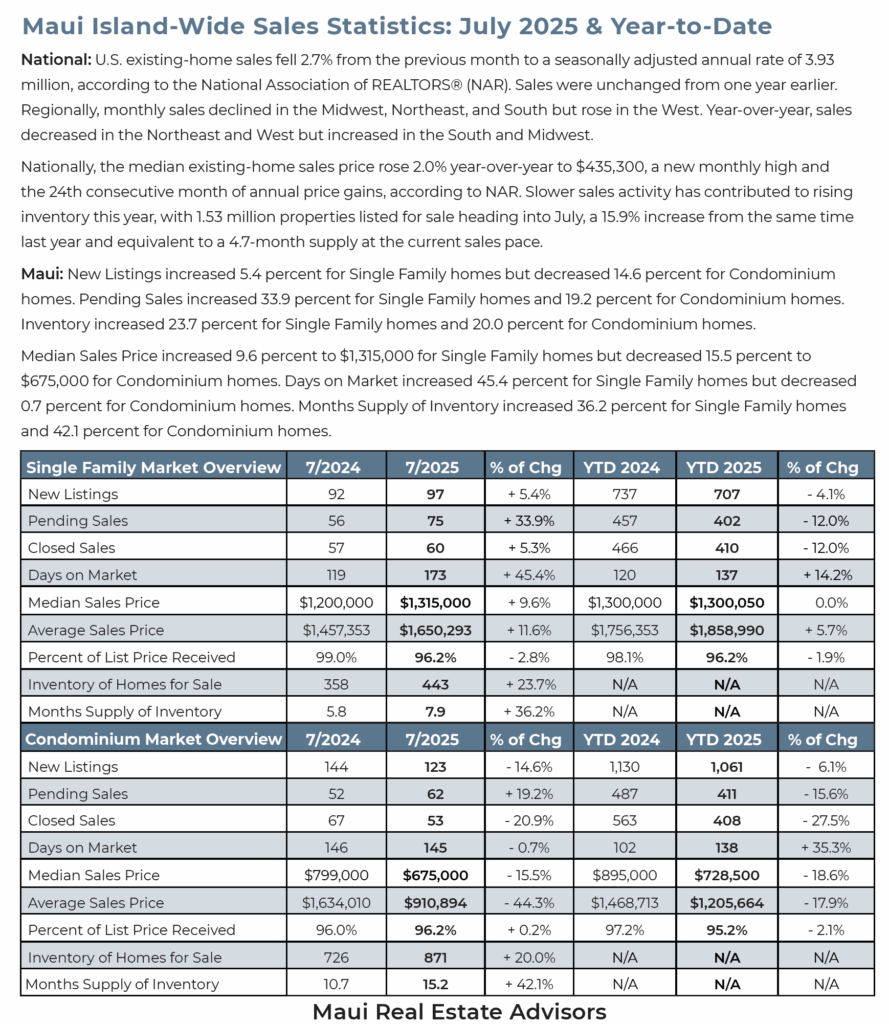

The most eye-catching number this month? The median sales price for condos in July was $728,500 a 18.6% drop year-over-year. Condo values are clearly trending downward, while single-family home prices have shown only modest declines, a sign of relative stability in the single family homes segment.

Other interesting highlights from July’s Stats over the overall market (Single-Family and Condos combined):

- Inventory is up 36.3% year-over-year, giving buyers more to choose from.

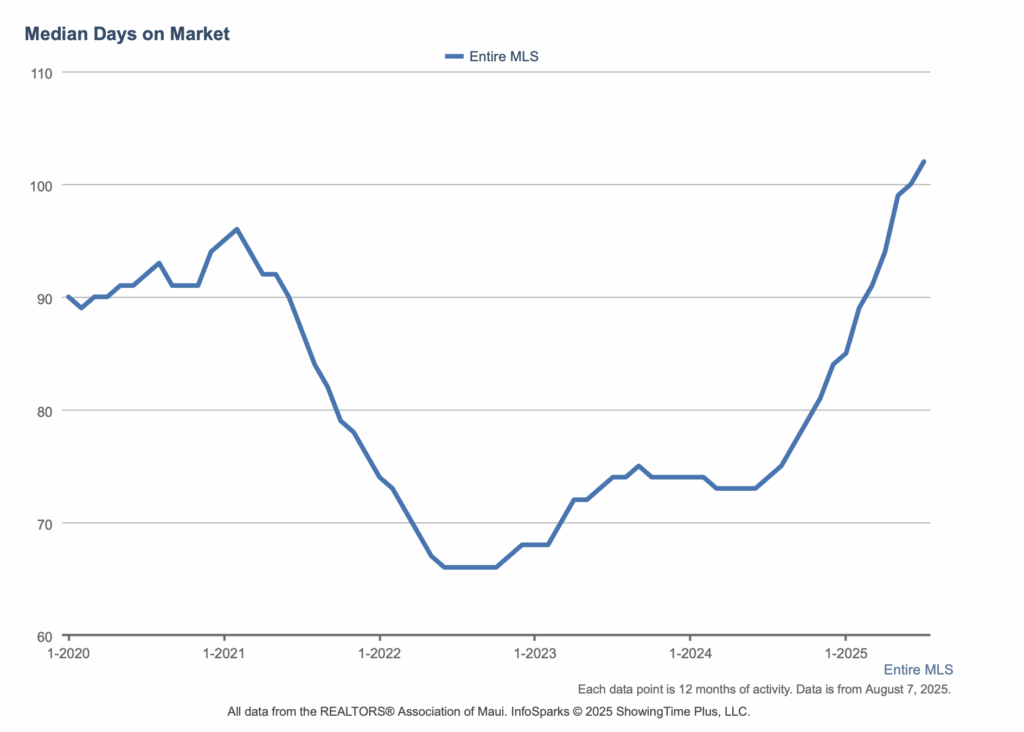

- Days on Market have increased 40.5% to 142 days on average, signaling slower movement.

- Months of Inventory sits at 14.2 months, well into buyer’s market territory.

For sellers, this means pricing in line with current market conditions is critical as well as being flexible during negotiations. For buyers, it’s an opportunity to negotiate more favorable terms, explore a broader range of properties, and take time without the bidding wars of years past.

The overarching trend across the island is unmistakable: Maui has entered a sustained buyer’s market. Months of inventory rose 42.1% year-over-year for Condominiums, now sitting at 15.2 months, the highest it’s been in 5 years. Properties are taking longer to sell, with the average days on market for a Single Family Home around 173 days, an increase of 45.4%.

Combine that with a 20% increase in overall inventory compared to last year and you get a market where buyers have more options, and more time to make them.

Let’s dig into the numbers:

Single-Family Homes: Slower Sales, Solid Prices

While sales have slowed and inventory is increasing, single-family home values are showing little change so far this year.

- Median Sales Price: $1,300,050 a 0% change from last year.

- Average Sales Price: $1,858,990 actually up 5.7% over last year

- New Listings: Down 4.1% from last year

- Pending Sales: Down 12% from last year, trending lower overall since the peak in May 2023.

- Days on Market: Up 14.2% YoY, to 173 days, and the highest in 5 years.

- Months of Inventory: 7.9 months, an increase of 36.2% over last year.

What this means:

In today’s slower market, the right pricing and presentation are critical for attracting serious buyers, even in the luxury segment. Buyers are taking their time, but they’re willing to pay for homes that check the boxes.

Condos: Clear Buyer’s Market Conditions

The condo segment continues to shift in favor of buyers.

- Median Sales Price: $728,500 down 18.6% YoY continuing a gradual decline over the past year.

- Average Sales Price: $1,205,664 YTD down 17.9% one of the sharpest drops in recent history.

- New Listings: Down 6.1% from last year

- Pending Sales: 411 YTD an decrease of 15.6% from last year.

- Closed Sales: Down 27.5% from last year, hitting the lowest level in a decade.

- Days on Market: 138 days YTD – highest in 5 years

- Months of Inventory: 15.2 months.

Translation:

Buyers have more options, more leverage, and more time. For sellers, strategy matters more than ever, especially when it comes to pricing and standing out in a crowded field.

Local & National News Impacting the Market

Bill 9 Advances, Major Impact on Condo Investors

In July, Maui County Council’s Housing & Land Use Committee advanced Bill 9, which phases out short-term rentals in many apartment-zoned condos. The Bill still has to go through 2 full County Council Hearings & Final Vote before the Mayor can sign it into law. While exemptions are being explored, the clock is ticking for owners in affected buildings. This legislative shift is a key reason for the surge in condo inventory and falling prices. More buyers are moving carefully and taking time to evaluate their options, while some investors are reassessing strategies in light of shifting conditions. It’s important to note that not all properties are affected by this legislation. However, even some unaffected condos are seeing price adjustments simply because the overall market has slowed. For buyers working with an experienced Realtor, this environment can present opportunities to secure the right property at the right value whether for personal use or as a vacation rental.

Mortgage Rates Easing Slightly

While interest rates are still above historic lows, the recent dip, as reported by the Associated Press, is providing much-needed breathing room for buyers. Even a small drop improves monthly affordability and can be the push buyers need to act.

Hawai‘i’s Economic Forecast Holds Steady

According to the DBEDT, Hawaii’s economic growth forecast remains slow but stable. Tourism continues to rebound, and long-term outlooks remain cautiously optimistic. A steady economy helps reduce volatility in the real estate market, supporting both investor and homeowner confidence.

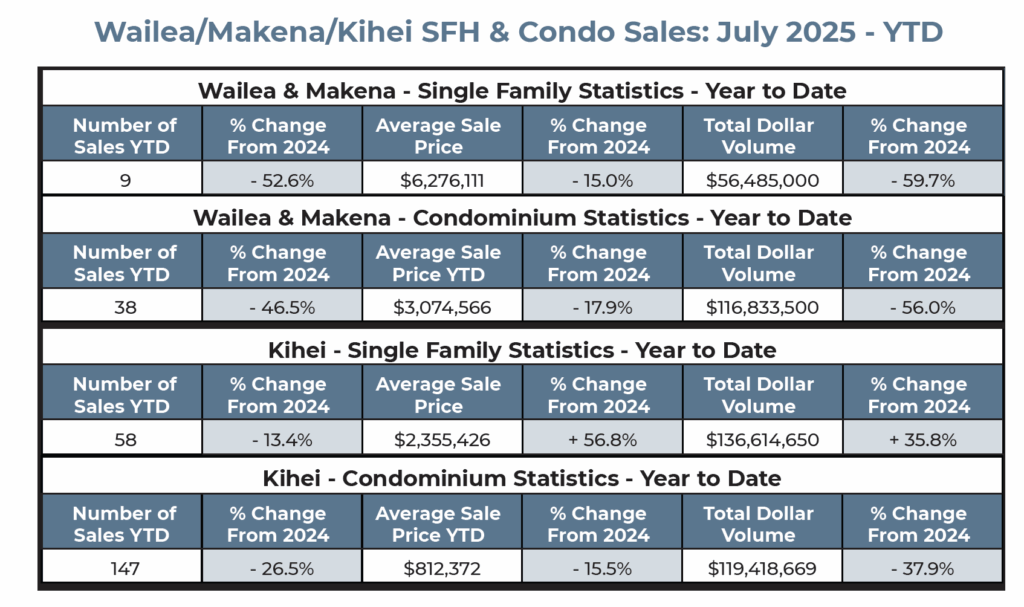

Spotlight on South Maui: Wailea & Kihei Hold Their Ground

While much of Maui saw softening sales and pricing in July, Wailea and Kihei remained some of the most active and resilient regions.

Kihei

- Condo Sales Volume: $15.7M across 21 sales

- Single-Family Home Sales Volume: $16.9M across 11 sales

Kihei continues to draw strong interest thanks to its walkable beaches, short-term rental zones, and inventory variety. With 21 condos sold, Kihei was the most active region for condo sales.

Wailea/Makena

- Condo Sales Volume: $13.4M across 6 sales

- Single-Family Home Sales Volume: $5.5M across 2 sales

Though fewer in number, Wailea and Makena’s transactions represent high-value luxury deals, with a median condo sale price of $1.9M and homes $2.7M. These numbers reinforce the enduring demand for South Maui’s luxury inventory, even in a slower market.

Takeaway: Kihei continues to lead in volume and breadth of transactions, while Wailea/Makena sees fewer but higher-value deals. Compared to regions like Lahaina (just 5 condos and 1 home sold in July), South Maui clearly remains one of the island’s most desirable and active markets for both buyers and sellers .

July 2025 Key Takeaways for Sellers

- Single-family home prices remain stable overall, though sales are taking longer and competition for buyers is increasing. If you’re selling, now is the time to dial in pricing and ensure your marketing is world-class.

- Condos require strategy. With growing inventory and policy shifts, sellers must lead with clarity, transparency, and professionalism.

- Be proactive. Understanding your local zoning and future rental status is essential in this market.

Key Takeaways for Buyers

- There’s leverage. Especially in the condo segment, buyers have more room to negotiate and more time to explore.

- Financing may improve. A slight drop in rates could mean better affordability for those ready to act.

- Wailea, Kihei & Makena remain competitive. Inventory is tighter here than other areas, and well-located properties continue to draw attention.

Final Thoughts

The July numbers tell a story of contrast: stability in single-family homes pricing, and softness in the single-family & condo market, with a landscape shaped by legislation and lifestyle shifts. Whether you’re buying your piece of paradise or rethinking your investment, navigating Maui’s market right now requires local expertise, patience, and a plan. When you’re ready, we’re here to help you make the right move.

With Aloha,

All information taken from Hawaii Information Services, MLS Sales Data, information shown herein, while not guaranteed, is derived from sources deemed reliable. This market analysis represents our opinion of Maui Real Estate based on available data and should not be considered financial or legal advice.

Curious about the property in our featured image? It’s our listing at 164 W. Ikea Moku, a 3 bedroom/3.5-bath home for sale in Wailea. Full details at www.WaileaHome.info.