Condo Prices are Declining, Inventory Surges, and Savvy Buyers Take Note

Big Picture: Buyers Are Back in the Driver’s Seat

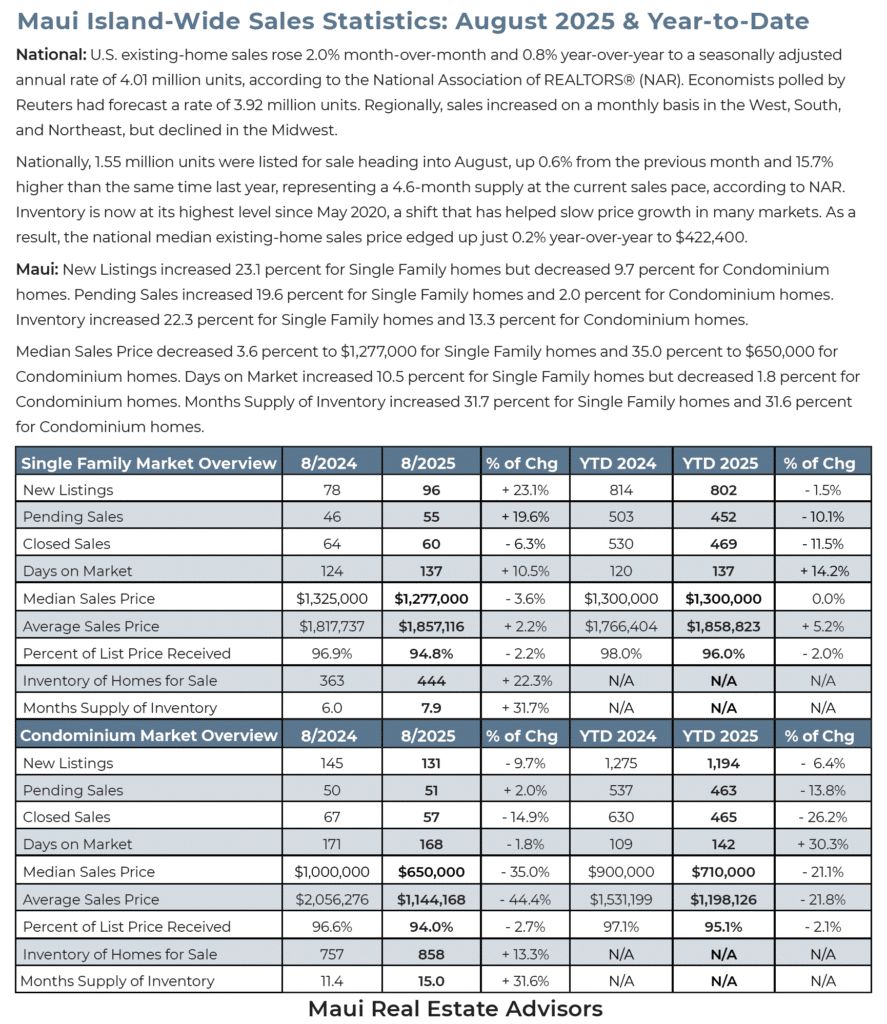

Maui’s real estate market is continuing to shift and this time, the numbers are telling a clearer story. While national headlines point to some isolated mild improvements in home sales and inventory growth, Maui is seeing something more dramatic in our Condo market. Condos are seeing meaningful price corrections, inventory is climbing across the board, and buyers are taking their time, using the slowdown to their advantage.

Condo Prices Are on the Decline

One of the most telling shifts this year has been in the condo market. The median sales price for condos in August dropped to $650,000, down 35.0% year-over-year and 21.1% year-to-date

But the story goes beyond a single month.

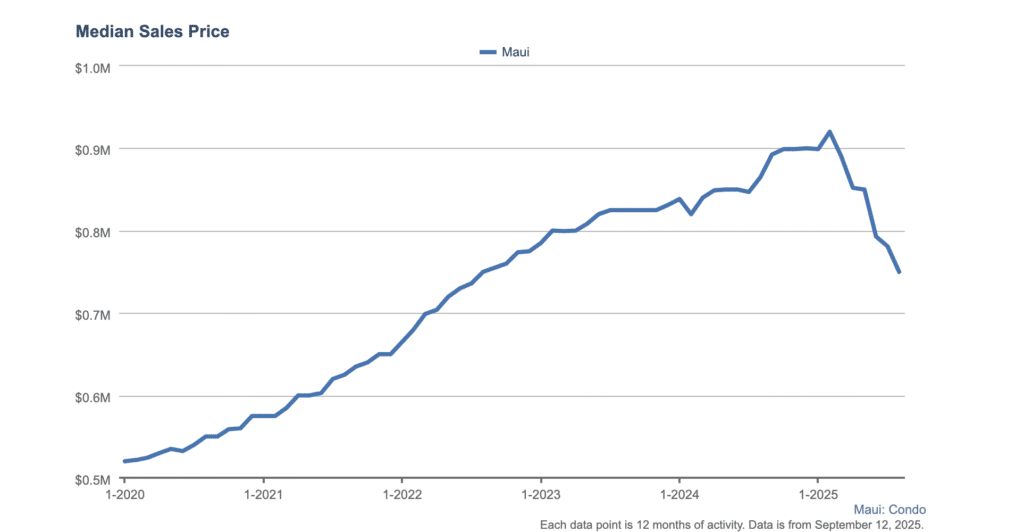

Below is a chart of Maui’s median condo prices over the last 5 years:

Last time Condo prices in Maui were this low was in 2022!

→ Median prices peaked in February 2025 and have been on a steep decline over the past 7 months, returning to levels not seen since 2022.

This trend isn’t just seasonal, from our perspective it’s mainly the legislative uncertainty mostly around Bill 9. As a result we’ve been seeing a combination of rising inventory and longer days on market is cooling demand and creating more room for buyers.

Single-Family Homes: Stable, but Softer

While condos are making headlines, the single-family market is showing a more stable, yet slightly softened, trajectory.

- Median Sales Price: $1,277,000 (–3.6% YoY)

- Average Sales Price: $1,857,116 (+2.2% YoY)

- Closed Sales: 60 (–6.3% YoY)

- Inventory: 444 homes (+22.3% YoY)

- Months Supply: 7.9 months (+31.7%)

- Days on Market: 137 days (+10.5% YoY)

YTD median pricing is holding at $1.3M, but increased supply and buyer hesitation are pressuring sellers to adjust expectations. Properties that show well, are priced right, and offer flexibility are still getting attention.

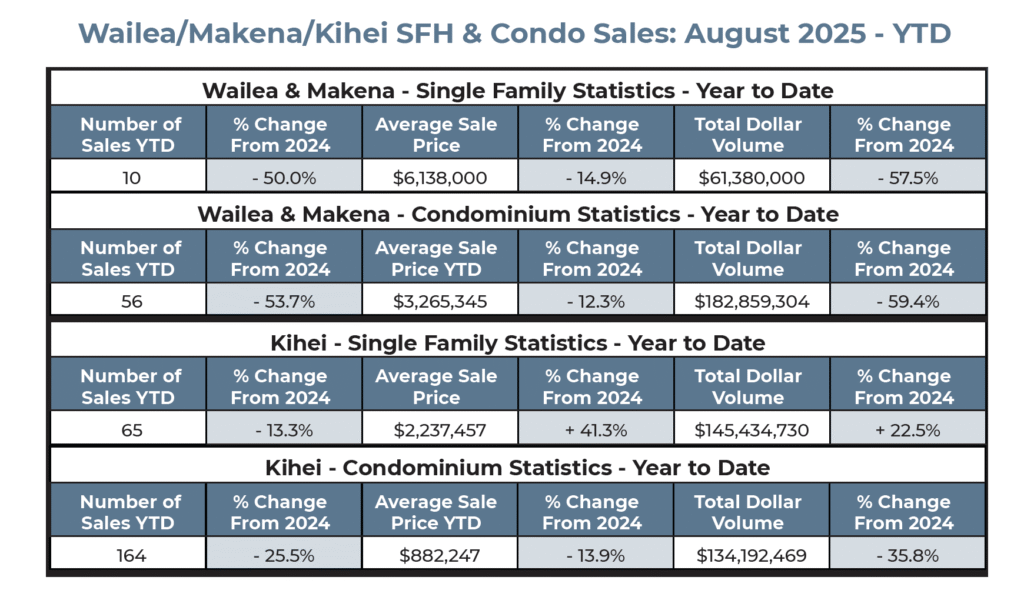

Regional Highlights

- Wailea/Makena condos led all regions with $182.8M in closed sales, showing that demand remains for luxury, when priced appropriately.

- Kihei condos had 17 sales with a $710,000 median, reflecting strength below the high-end tier.

- Wailuku and Makawao had the most single-family activity, though most regions are seeing longer timelines to sell.

Local & National News Impact

Nationally, housing inventory reached its highest level since May 2020. On Maui, that’s translating into more choice and longer selling times. Locally, Bill 9, which proposes phasing out short-term rentals in apartment-zoned condos, moved forward in August. It still faces two full Council votes before becoming law — but uncertainty alone is shaping buyer behavior.

🔍 Important: Not all properties are affected by this legislation. Yet even unaffected units are seeing price adjustments because the broader market has slowed. This is where informed guidance matters most.

What It Means for Sellers

- Flexibility is key: Price conservatively, especially in the condo space.

- Presentation matters: Well-staged and move-in ready properties stand out.

- Know your building’s zoning: If you’re unaffected by Bill 9, that’s a potentially marketable advantage.

What It Means for Buyers

- You have leverage: Inventory is up, and many sellers are open to negotiation.

- Timing is on your side: Prices are adjusting, and rates remain a major factor.

- Work with experience: The difference between a smart buy and a risky one can come down to zoning details and long-term use potential. Our team brings 60+ years of combined local experience to help you navigate these complexities with clarity and confidence.

Final Thoughts

We’re in a moment of opportunity. For some buyers, this is the opening they’ve been waiting for. For sellers, understanding the new landscape is essential to avoid sitting stale. Whether you’re buying, selling, or simply reevaluating your plans, having the right strategy makes all the difference.

With Aloha,

All information taken from Hawaii Information Services, MLS Sales Data and news sources, information shown herein, while not guaranteed, is derived from sources deemed reliable. This Maui real market analysis represents our opinion of Maui Real Estate based on available data and should not be considered financial or legal advice.