As we head deeper into spring, Maui’s real estate market continues to shift and in many ways, the patterns we observed earlier in the year have solidified. Inventory continues to rise, sales volume is declining, and homes and condos are sitting on the market longer. Buyers have more options than they’ve had in years, and while pricing remains resilient in many areas, strategic positioning is now the name of the game.

If you’re considering buying or selling property on Maui, understanding the current rhythm of the market is key to making smart, confident decisions.

A few things we’ve noticed over the past few months are:

Condo Prices Are Adjusting

- 📈February: Median price spiked to $945,000 (+27.7% YoY)

- 📉March: Fell to $822,500 (–36.8% YoY)

- 📉April: Dropped further to $727,000 (–24.5% YoY)

- 📢Trend: Prices are adjusting after a February spike. This presents buying opportunities, especially in Kihei and Central Maui. Navigating these shifts without an expert can be costly. In a market this nuanced, working with someone who understands both the data and buyer psychology ensures your move is smart, timely, and informed.

Single-Family Home Prices Holding

- ✅ Median price hovered around $1.3M in both March and April.

- ✅ Despite fewer sales, prices remain relatively stable, supported by high-end closings.

- 📢 Trend: The luxury market is propping up the average, while mid-tier homes need strategic pricing to move.

Days on Market Fluctuate

- ✅ Single-family homes: 125–133 days average over the past 3 months

- 📈 Condos: Increased steadily, hitting 145 days in March and 146 days in April

- 📢 Trend: Buyers are more deliberate. Strong presentation, strategic pricing, and standout marketing are non-negotiables.

Closed Sales Are Down Across the Board

- 📉 Condos: Down 35-40% YoY in both March and April

- 📉 Single-family homes: April closed sales only fell by – 4.2% YoY

- 📢 Trend: Buyer hesitancy is real—but well-priced, well-marketed properties still sell.

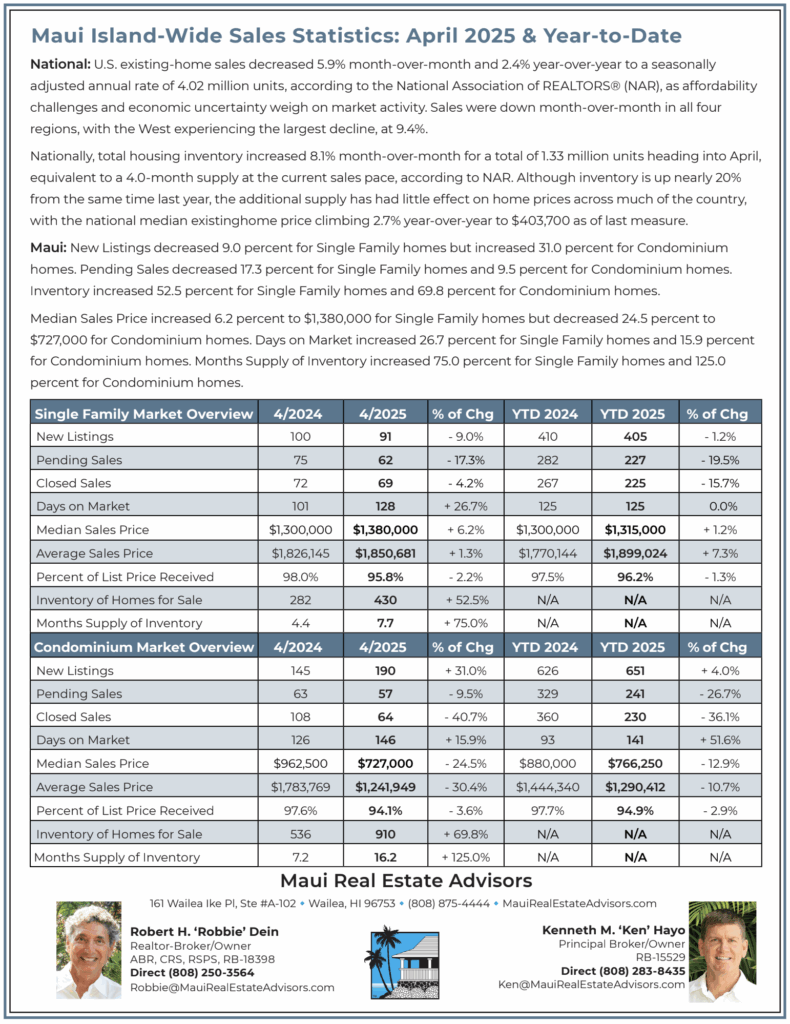

Here is an in-depth look at the numbers:

Single-Family Homes: More Inventory, Slower Sales, but Prices Hold

The single-family home segment remains steady on pricing—but everything else suggests a more cautious, buyer-driven landscape.

- 📈 The median home price rose to $1,380,000, a 6.2% increase year-over-year. Despite this, the number of closed sales fell 4.2%, and pending sales are down even further—a 17.3% drop YoY, showing hesitation from buyers.

- 📈 Inventory rose 52.5%, and we now have a 7.7-month supply of homes—up 75% from last year. That’s a meaningful shift toward a buyer’s market.

- 📈 Homes are also taking longer to sell, now averaging 128 days on market, up 26.7%.

- 📉 Sellers are receiving slightly less than asking—95.8% of list price, as buyers negotiate more firmly.

Takeaway: If you’re selling, the data makes one thing clear—price competitively, prepare your property thoughtfully, and market with intention. Buyers are no longer rushing in. They’re choosing carefully.

Condominiums: Prices Cool After a Spike, Supply Surges

The condo market tells a different story. After February’s brief surge in median pricing, April has pulled back significantly.

- 📉 The median condo price dropped to $727,000, down 24.5% year-over-year. This is the second sharp monthly correction since the peak in February.

- 📉 Maui Condo sales have dropped by 40.7%, and pending sales also dropped 9.5%.

- 📈 Inventory continues to climb—now up 69.8%—and we’ve reached 16.2 months of condo inventory, more than double where we were last year.

- 📈 Days on market rose to 146 days, up 15.9%, and percent of list price received dipped to 94.1%.

That said, the affordability index for condos improved to 55—a 37.5% increase. For buyers, this means better value and more room to negotiate.

Takeaway: We’re firmly in a buyer’s market for condos. If you’re selling, work closely with your agent on pricing and presentation. If you’re buying, this is a rare window to act with leverage.

Overall Trends: A Market That Rewards Smart Moves

Across all property types:

- 📉 Closed sales are down 21.6%, and pending sales fell 17.0%.

- 📈 Inventory surged 52.9%, while days on market hit 148 days on average.

- 📈 Despite slower activity, the median price rose 5.4% to $1,172,500, suggesting sellers are holding on—but buyers are becoming more selective.

- 📉 Sellers are receiving 94.6% of asking price on average, which continues to trend downward.

- 📈 The overall months supply of inventory now sits at 12.3 months, up 86.4% from last year.

If this sounds familiar, it should. These trends have been building over the past three months, with February and March setting the tone for where we are today. More choices for buyers. Longer timelines for sellers. And more negotiation in every deal.

What This Means for You

For Sellers:

The buyers are still out there—but they’re patient, informed, and have options. Overpricing will cost you valuable time, and ultimately, money. The homes that are selling are well-positioned, well-marketed, and strategically priced.

A few key takeaways:

- ✅ Luxury is still moving—but slower. If priced right and well-presented, buyers are still engaging.

- ✅ Mid-market homes and condos must stand out. Professional marketing and pricing strategy are critical now.

- ✅ Aligning your pricing with where the market is going—not where it was—is what separates homes that sell from homes that sit.

For Buyers:

This is the most balanced market we’ve seen in years. Inventory is up, pressure is down, and if you’ve been waiting to find the right opportunity, it may be time to act. Especially in the condo segment, where value is improving and sellers are more flexible.

A few key takeaways:

- ✅ More inventory, less competition = better negotiating power.

- ✅ Condo pricing has softened, especially in Kihei and Wailuku—great time to act before rates shift or demand returns.

- ✅ With luxury listings spending longer on the market, high-end buyers may find willing sellers open to negotiation.

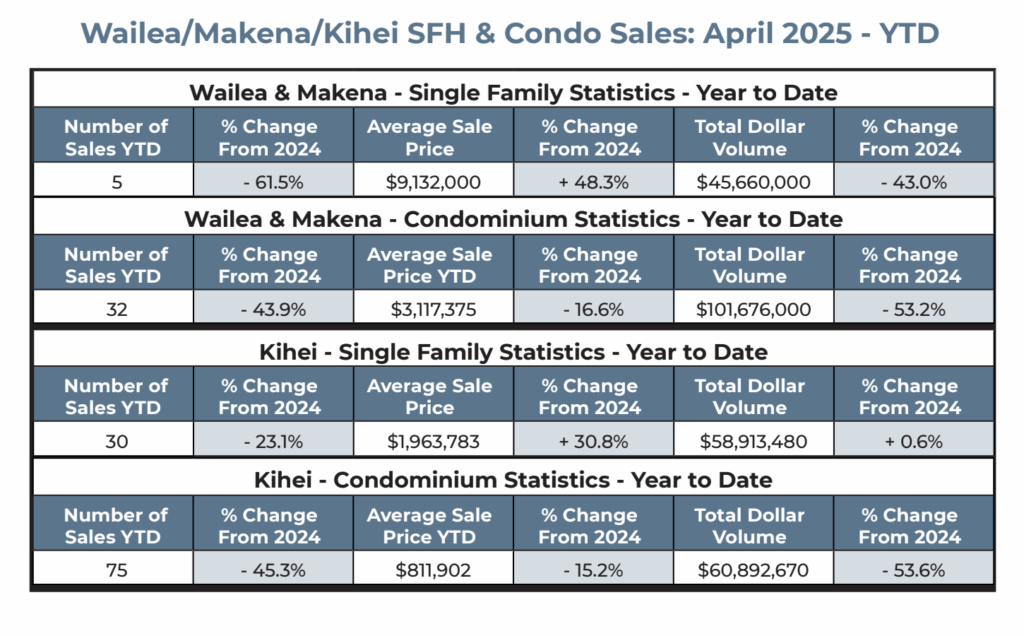

While Maui’s overall real estate market continues to shift toward a buyer-friendly environment, the real story is where the market is still moving and that’s in South Maui. Specifically, Kihei and Wailea are seeing meaningful activity across both single-family homes and condos, even as other regions slow down.

A Closer Look at South Maui:

Island-wide, condo prices took a step back in April, with the median sales price dropping 24.5% year-over-year to $727,000, and sales volume declining 40.7%. But when we zoom in, Kihei and Wailea tell a different story:

- ✅ Kihei condos: 75 units sold YTD with a combined dollar volume of $60.9M, with 19 sold in April 2025.

- ✅ Wailea/Makena condos: 32 units closed YTD for a massive $101.6M in sales volume, with a median price of $3.5M. Single Family Homes: year-to-date sales in the area remain strong at $45.7M across just 5 Wailea homes.

Even in a slower market, these numbers highlight strong demand in Maui’s most desirable areas. These aren’t just active areas—they’re outperforming the broader market. If you’re thinking about selling in South Maui, the window to act while demand is concentrated here is now.

If you’re selling in the South Maui: Kihei/Wailea/Makena area your success will still hinge on how your property is presented, priced, and marketed. Buyers are savvy right now, but they’re still showing up in the areas they love most. But as always on Maui, the best listings don’t sit long and that’s especially true in South Maui, where we recently had 1 listing go under contract in 6 days.

Final Thoughts

The Maui real estate market isn’t stalling, it’s evolving. And in markets like this, timing, presentation, and expert strategy make all the difference. Inventory is rising, buyer behavior is changing, and price sensitivity is growing. Whether you’re selling a home or looking to buy one, the Maui market in April 2025 demands a thoughtful approach. Whether you’re buying or selling, the key to success in this market is clarity, strategy, and experience.This isn’t a market to rush or to guess. It’s one where experience, strategy, and execution matter more than ever.

With over 60 years of combined experience and a proven track record representing Maui’s most discerning buyers and sellers, our team is here to help you make the right move.

Let’s talk about how to navigate this market together—with clarity, confidence, and results.

With Aloha,

All information taken from Hawaii Information Services, MLS Sales Data—information shown herein, while not guaranteed, is derived from sources deemed reliable. This market analysis represents our opinion of Maui Real Estate based on available data and should not be considered financial or legal advice.

Curious about the home in our featured image? It’s our listing at 3885 Wailea Ekolu Place. Full details at www.wailea.info.