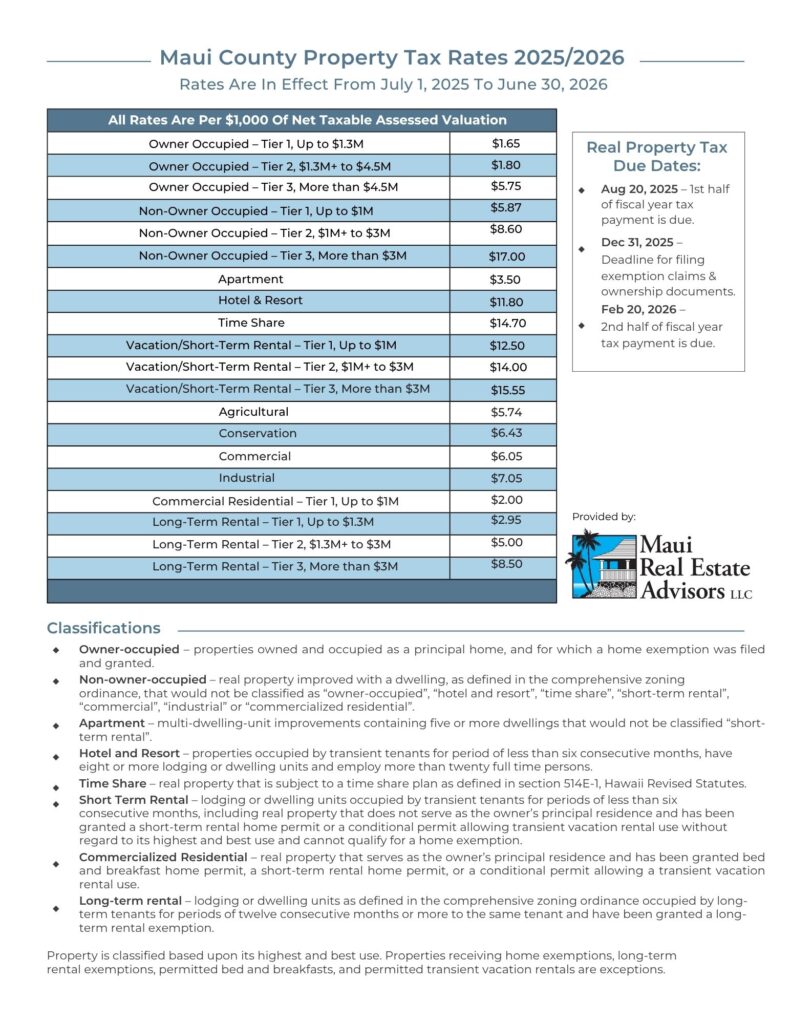

2025 Maui Property Tax Rates have officially been updated as part of the County Council’s newly approved $1.55 billion budget for the 2025–2026 fiscal year. These rate adjustments aim to support disaster recovery, housing development, and essential public services—while keeping costs reasonable for local residents.

If you’re planning to buy, sell, or invest in Maui real estate, understanding the Property Tax Rates is essential. Here’s what’s changing—and what it could mean for your next move.

What’s New in the 2025 Maui Property Tax Rates?

The County Council’s approved budget includes updated tax brackets aimed at balancing public investment with affordability. While the budget grew by $88 million from the previous year, the county is using a more progressive tax structure to fund essential services without placing the burden on local residents.

Key Highlights:

- – Increased tax rates for short-term vacation rentals, hotels, and luxury second homes

- – Reduced or unchanged rates for long-term rentals and owner-occupied residences

- – New tax tiers added for high-value properties to create a more progressive system

- – Maui still maintains the lowest property tax rates in the state, despite adjustments

These rate changes support wildfire recovery efforts, expand affordable housing opportunities, and reinforce infrastructure—all while safeguarding local residents from significant increases.

View 2025 Maui Property Tax Rates

How the 2025 Maui Property Tax Rates Affect Maui Real Estate

1. Buyers: Pay Attention to Classification

Before purchasing, it’s crucial to understand how your property will be classified. A home used as a short-term rental or second residence may be taxed at a higher rate than one used as a primary residence. This will affect your annual ownership costs. Before buying, make sure you know how the property will be assessed under the 2025 Maui property tax rates.

2. Sellers: Be Ready to Answer Questions

Sellers in areas like Wailea, Kaanapali, and other luxury markets should be prepared to address how these changes may impact buyers’ cost projections—especially for vacation rental properties. Highlighting location, lifestyle, and rental income potential remains key, but cost transparency will matter more than ever.

3. Investors: Reevaluate the Math

For those purchasing with rental income in mind, updated tax brackets could alter cap rates. Short-term rental owners in particular may want to revisit financial projections and work with local experts to navigate potential zoning and tax implications.

4. Primary Homeowners: A Win

Owner-occupants and long-term rental owners benefit the most from the 2025 Maui property tax rates. With lower tiers and continued exemptions, Maui is reinforcing its support for full-time residents and local landlords.

Why These Tax Changes Matter Now

Maui County’s tax policy is becoming a more powerful tool in shaping housing priorities. These Maui property tax rates reflect a commitment to long-term affordability, local housing stability, and smart public investment.

Whether you’re a buyer, seller, or investor, understanding these updates is essential to making informed decisions in today’s Maui real estate market.

With over 60 years of combined experience, our team stays ahead of local policy changes so you can move forward with confidence.

With Aloha,